Now Reading: Comprehensive Guide to the ATM Transaction Sequence Diagram

-

01

Comprehensive Guide to the ATM Transaction Sequence Diagram

Comprehensive Guide to the ATM Transaction Sequence Diagram

Introduction

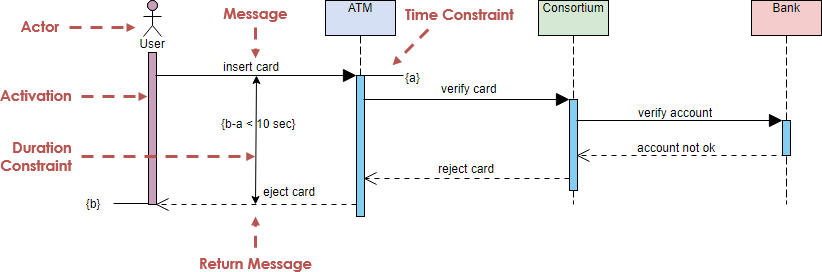

The sequence diagram provided illustrates the process of an ATM (Automated Teller Machine) transaction, highlighting the interactions between the user, the ATM, the consortium, and the bank. This guide will explain the key concepts and steps involved in the diagram, using a use case scenario to elaborate on the process.

Key Concepts

Actors

- User: The individual initiating the ATM transaction.

- ATM: The machine that interacts with the user and communicates with the consortium and bank.

- Consortium: An intermediary entity that verifies the card and communicates with the bank.

- Bank: The financial institution that verifies the account and processes the transaction.

Constraints

- Time Constraint: The time limit within which certain actions must be completed.

- Duration Constraint: The maximum duration allowed for a specific action.

Messages

- Activation: The initial action taken by the user to start the transaction.

- Message: Communication between the actors.

- Return Message: The response or feedback sent back to the user.

Use Case Scenario

Let’s consider a scenario where a user, John, wants to withdraw cash from an ATM.

Step-by-Step Process

-

User Activation:

- John approaches the ATM and inserts his card into the machine. This action is represented by the “insert card” message from the user to the ATM.

-

ATM Processing:

- The ATM receives the card and initiates the verification process. It sends a “verify card” message to the consortium.

-

Consortium Verification:

- The consortium receives the verification request and checks the card’s validity. If the card is valid, it sends a “verify account” message to the bank.

- If the card is invalid, the consortium sends a “reject card” message back to the ATM.

-

Bank Verification:

- The bank receives the account verification request and checks the account status. If the account is in good standing, it sends a confirmation back to the consortium.

- If the account is not okay, the bank sends a “account not ok” message back to the consortium.

-

Consortium Response:

- The consortium receives the bank’s response and forwards it to the ATM.

- If the account is verified, the ATM proceeds with the transaction. If the account is not okay, the ATM rejects the card.

-

ATM Feedback:

- The ATM provides feedback to John. If the card is rejected, the ATM ejects the card, and John receives a “reject card” return message.

- If the account is verified, the ATM allows John to proceed with the transaction.

-

Transaction Completion:

- John completes the transaction (e.g., withdraws cash) within the specified time constraint (e.g., 10 seconds).

- The ATM ejects the card, and John receives a “return card” message.

Conclusion

The sequence diagram provides a clear and structured representation of the ATM transaction process, highlighting the interactions between the user, ATM, consortium, and bank. By understanding the key concepts and following the use case scenario, one can grasp the intricacies of the ATM transaction process and the importance of each step in ensuring a successful transaction.